Swiss architect Walter R. Stahel first introduced the notion of a

circular economy in the 1970s. Stahel

was one of the forerunners of the sustainability movement, advocating that the

industrial economy did not have to be tied to mindless consumption and waste.

Instead, Stahel proposed that resources could not only be recovered at the end

of their lives, but even upgraded.

In 2002 architect William McDonough and

chemist Michael Braungart brought the concept of circular product lifecycles to

the wider public in their aptly titled book, Cradle to Cradle: Remaking the Way we Make Things. At its core, Cradle-to-Cradle

(C2C) design, as opposed to Cradle-to-Grave (i.e. landfill) design, advocates

for designs to be modeled on nature’s regenerative cycles.

Using the analogy of a colony of ants,

McDonough and Braungart propose that productivity does not have to be

associated with environmental degradation. Instead, the two authors illustrate

a world in which designing for abundance actually bolsters the beauty, health

and productivity of our ecosystems.

Transitioning decades of products and

services designed in a linear modality into a true Cradle-to-Cradle economy is

going to take time. That said, many companies who have embraced the holistic

mindset are beginning to (re)design products and services to be as inherently

good as possible.

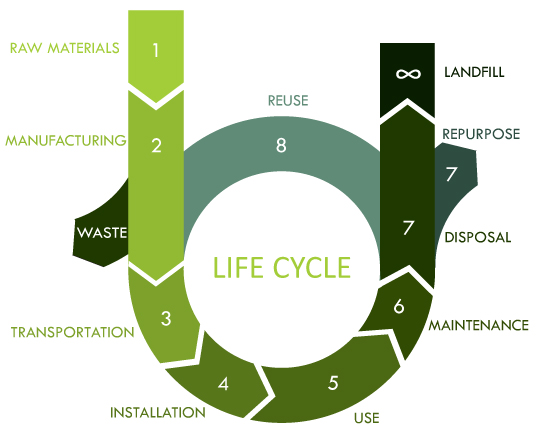

One of the principle tools to evaluate

a product or service’s environmental impact is Life Cycle Analysis (LCA). Through

LCA an existing or future product or service undergoes a comprehensive assessment

that considers its environmental

impacts all the way from materials extraction, processing and

manufacturing to use and disposal. The breadth of information this analysis

requires can be hard to come by so LCA is only as useful as the amount, validity,

and relevancy of data available.

|

|

Apartmenttherapy.com, 2010

|

Despite its complexities LCA is growing

in popularity. One of the main reasons for this is Environmental Product

Declarations (EPDs). EPDs originated in Europe in

1993 (International Standards Organization 14025) and use LCA analysis as a way

to offer businesses and consumers a reliable way to make quantifiable

comparisons of the environmental impact of different goods and services. In

order to ensure that all products are evaluated in a consistent manner, Product

Category Rules (PCRs) are developed, specific to industry, and outline what

data is to be used in the LCA. Analyses are then regulated by a third-party to

ensure a level, objective, playing field.

With respect to the flooring industry,

in 2009 Interface became the first North American company to register an EPD

for its ConvertTM line of products. At that time, president of

InterfaceFLOR division, David Hobbs, said,

“We were eager to

create and have verified an EPD to raise the bar, move our industry and provide

the model and foundation for our competitors to follow. Ultimately this will

allow our customers to make apples-to-apples comparisons of carpet products.

Now our competitors need to get on board and do their own EPDs” (Greenbiz, 2009).

The industry did just that; most recently in

June of this year J+J Flooring Group and Mannington Commercial completed EPDs

on a variety of their products (NSF, 2013).

The popularity of EPDs is expected to

grow with the upcoming release of LEED V4 Green Building Rating System

Standards. In contrast to the Materials & Resources section of LEED 2009 where

credits were awarded according to single attributes of materials, such as

recycled content, LEED V4 applies lifecycle thinking; subsequently introducing

and endorsing the concepts of EPDs.

As carpet is found in almost every

building or home, CARE looks forward to seeing how the introduction of EPDs

will influence carpet recycling in the coming years. It is interesting to note, when CARE started

in 2002 there was virtually no closed loop recycling of carpet. Today nearly

30% of all carpet that is recycled goes back into carpet face fiber and

backing. Ultimately, whether or not carpet goes directly back to its cradle,

the days of carpet to landfill are dwindling!